401k investments are often the entry point for young investors into the market. There are a lot of factors that can and should influence an investor’s strategy for 401k selection, but the two most important decisions are:

- Should I invest in a Roth 401k or a Traditional 401k?

- What types of assets should I pick within it?

This article was originally published May 4, 2019 and was updated on September 5, 2022.

401k plans: What are they and how do I pick between them?

Roth and Traditional 401k vehicles are both designed to provide investors with tax-advantaged savings. They are both offered through your employer and they both have a limited menu of funds that you can invest your money in, hand-picked by a fund sponsor.

They differ in when the tax advantage is realized.

Traditional 401k

Traditional 401ks are tax deferred vehicles that can be started with pre-tax money. Tax deferred investments allow investors to delay tax consequences until withdrawal of funds from the vehicle. For example, investors can take pre-tax income and invest in a traditional 401k, shielding that income from current taxation. The investments will then grow, tax-deferred, within the vehicle. During retirement, the investor will make withdrawals from the vehicle, triggering income, dividend, and capital gains taxes that have been deferred until now.

Roth 401k

Roth 401ks are tax free vehicles that must be started with after-tax money. Tax free investments allow investors to avoid tax consequences for all asset growth and dividends for the vehicle’s investments. However, Roth 401ks must be funded with after-tax money. During retirement, the investor can make withdrawals from the vehicle without triggering any tax consequences.

Which is better?

Let’s look at some examples. We’re going to make some simplifying assumptions about:

- Tax rates. Everyone pays a single flat rate on income, dividends, and capital gains.

- We reinvest dividends within the vehicle in the same mix.

- Investment returns. Our investment portfolio earns 8% annually. The mix of dividend earnings and price growth doesn’t matter because they are treated equally from a tax perspective.

- We start with $15,000 in pre-tax income we would like to invest for our retirement in 30 years. We won’t be able to invest any more money in the years after that.

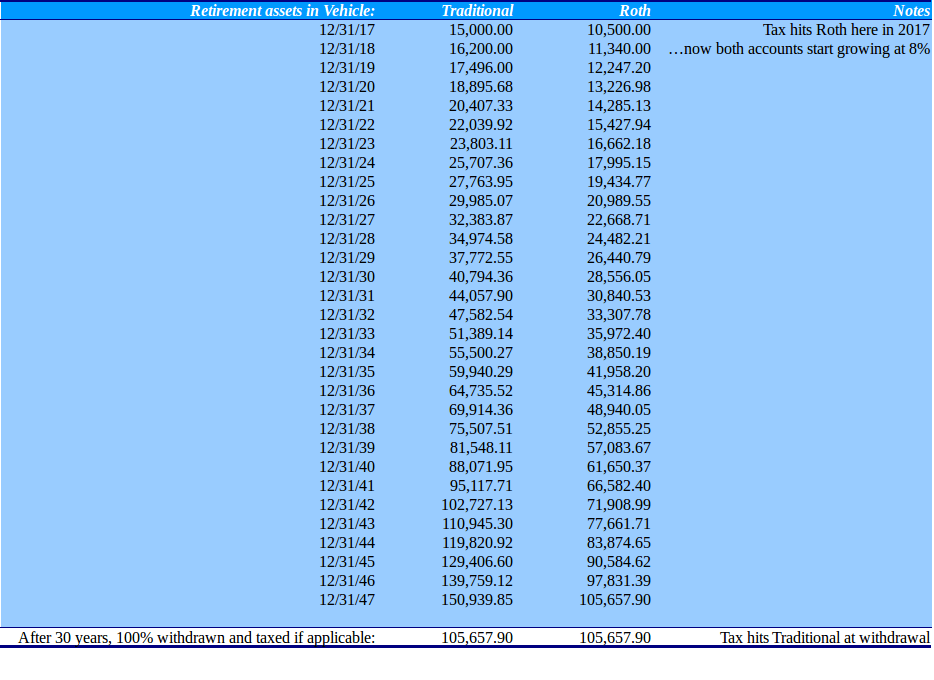

Let’s look at a 401k selection example where our tax rate starts at 30% now and ends up the same at 30% at retirement:

What about different tax rates?

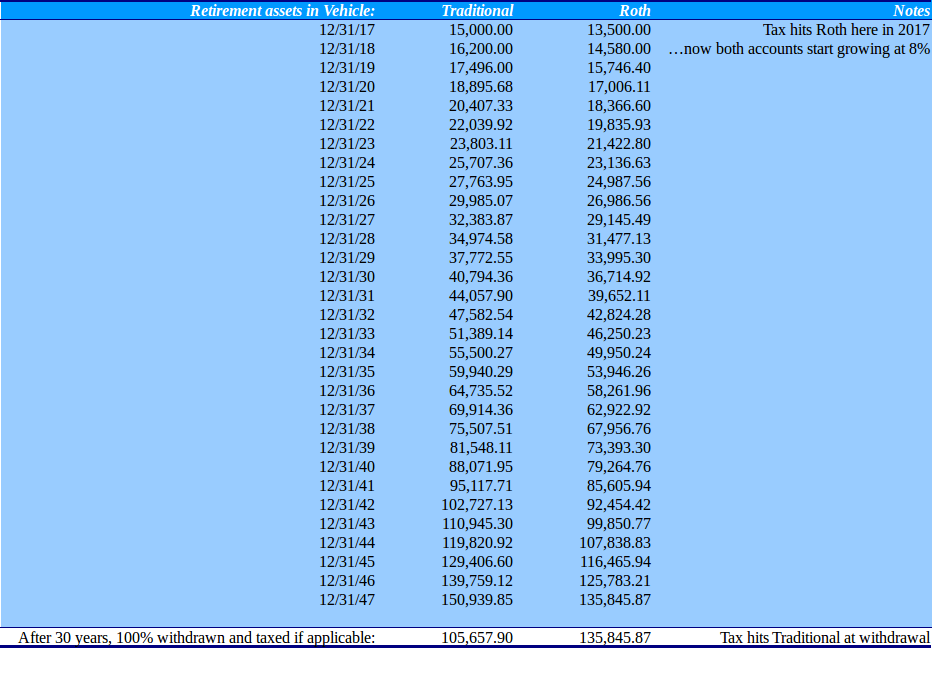

As you can see, in this simplified example, Roth versus Traditional made no difference! Both types of vehicles got us huge tax savings, but neither had an inherent advantage over the other. So let’s see what assumptions we can change to see a difference. What if our tax rate now is lower now (10%) than we expect it to be in the future (30%)? This is the case for most young, early-career professionals who may have lower earnings now but high earnings potential later, during their prime years:

In this case, the Roth 401k turned out much better. It was better to take the tax hit now, while our tax rate is low, rather than later, when our tax rate will be higher. Even though we have made a lot of simplifying assumptions, I generally advise younger, early-career professionals to use Roth IRAs and 401ks for this exact reason. Overall, when picking your retirement savings vehicle, think about your tax situation right now, your career and life plan leading up to retirement, and what that will mean for your tax situation then. No one has a crystal ball but thinking through these things can help you make an informed decision. Just remember, either way, you are getting A TON of tax benefit, so don’t sweat it if later it seems like you made the wrong choice.

401k selection: What funds to pick?

Every employer has a different plan setup but a lot of them follow a similar pattern. You will be faced with a pool of about 20 funds with different asset bases, fee structures, risk levels, and management styles. You’ll be asked to select the mix of funds you’d like to invest in, and a method of rebalancing the mix at certain intervals or thresholds. You’ll want to minimize fees across the board (below 0.30% is pretty good but ideally we’re looking for below 0.15%). Common fund types include:

- Broad US Equity Index Funds. These funds will try to replicate the S&P 500 index return and will usually have very low fees. You should probably pick some of this.

- Broad US Investment Grade Bond Funds. These funds will try to replicate a bond index like the ones provided by Barclays and JPMorgan. Fees are low and you should probably have some of this.

- US High Yield Bond Funds. These funds will benchmark of a US HY bond index but will not necessarily try to replicate exactly. Watch out for fees. These funds are run by people trying to beat the market and they typically want to get paid for that in fees.

- European / Asian Equity and Bond Funds. These funds invest in non-US developed markets. Fees range from very low to very high.

- Emerging Market Equity and Bond Funds. These funds invest in developing markets, but because of liquidity they tend to concentrate investments in a few markets like South America, Russia, etc. Fees can be very high.

- Target Date Funds. These funds have a date attached to them. A manager will adjust the balance of high risk and low risk investments to decrease the risk profile of the portfolio as the target date approaches. In practice this usually means adopting a US-focused investment mix of X%/Y% stocks / bonds. The fund will go from 80/20 to 20/80 as the target date approaches. This is a convenient way to modify your own portfolio risk as you get older without having to think about things too much. Fees are usually very low.

- Money Market Funds. These funds invest in very short term debt instruments to provide a very low or zero investment return and high probability of capital preservation. Fees can be surprisingly high but the real fee is the growth you give up by not investing in another asset. Avoid in most cases.

- REITS. Invest in special investment vehicles that own real estate properties. Fees can be very high. Typically offer very good diversification against other 401k assets.

- Active Funds. Might have a wider investment scope that allows the manager to tactically move between various asset classes. Goal is to deliver positive risk-adjusted returns. Fees are typically extremely high. Avoid.

- Company Stock. Many firms offer, and sometimes even encourage, the purchase of company stock within an employee’s 401k. I hate this practice. Don’t buy your own company’s stock. You are already, in a sense, “all in” on your company. If your company does well, you’re going to do well. If your company folds, you’re going to be in trouble. Don’t double down on the bet you’ve already made. Use your 401k portfolio to diversify your financial assets away from your personal and career assets.

Do the proportions matter?

So, pick a mix of whatever you feel comfortable with. You should probably have some US stocks, and some US bonds. For example, if fees are pretty low, you could do 40% US equities, 30% US bonds, 20% Euro / Asian, 10% EM. If you’re interested in optimizing further, a good financial adviser (like me!) can help you optimize your diversified portfolio using a variety of methods. The mix is important, but you shouldn’t let worries about getting the mix right delay you from getting your money into the tax vehicle as soon as possible. The most important thing is to get as much of your money into a tax-advantaged account as soon as practicable.

Don’t miss out on future posts!

Don’t miss any new posts! Sign up below to subscribe. I generally post once per month and I alternate between longer-form articles and short digests of interesting financial content from other sites I’ve found. Thanks for reading!

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.