The S&P 500 index, a widely followed benchmark of the U.S. stock market, has long been considered a reliable indicator of the overall health of the economy. However, a closer look at the index reveals a surprising concentration in big tech stocks. This phenomenon is not only a reflection of the growing dominance of technology companies in the market, but also a result of the market-weighted structure of the index. Let’s explore the reasons behind this concentration and discuss the potential risks it poses to investors.

I generated this text in part with OpenAI’s large-scale language-generation models. Upon generating draft language, I reviewed, edited, and revised the language to my own liking and I take ultimate responsibility for the content of this publication.

The Market-Weighted Structure of the S&P 500 Index

The S&P 500 index is a market-weighted index, meaning that the weight of each stock in the index is determined by its market capitalization. In other words, the larger the market cap of a company, the more significant its impact on the index’s performance. This structure has some advantages, such as providing a more accurate representation of the market’s overall value and ensuring that the index is not overly influenced by smaller, more volatile stocks.

However, this market-weighted structure also has some drawbacks, one of which is the potential for certain sectors or industries to become over-weighted in the index. This occurs when the market capitalization of companies within a particular sector grow disproportionately larger than those of other sectors. As a result, the performance of the index becomes more heavily influenced by the performance of that sector, which may not accurately reflect the broader market’s performance.

The Overweighting of Big Tech Stocks in the S&P 500 Index

Over the past decade, the technology sector has experienced tremendous growth, driven by the rapid expansion of companies like Apple, Amazon, Microsoft, Google parent Alphabet, and Facebook. These five companies have seen their market capitalizations soar, making them some of the largest companies in the world.

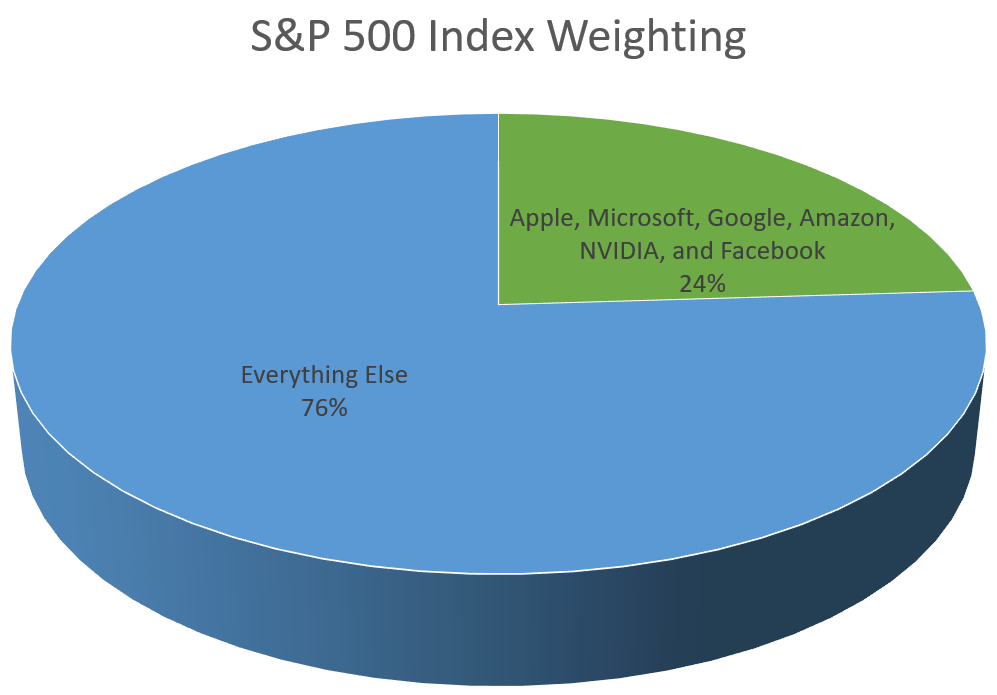

As a result of their growing market caps, these big tech stocks have become increasingly over-weighted in the S&P 500 index. As of May 2023, these stocks accounted for approximately 24% of the index’s total market capitalization. Nearly a quarter of the index’s performance is driven by the performance of just five companies. This fact is partially obscured because under GICS categorization, tech stocks can be categorized differently:

- Communications Services – Google, Netflix

- Consumer Discretionary – Amazon

- Financials – Paypal

- Information Technology – Apple, most other tech firms

Implications for investors

This over-weighting of big tech stocks in the S&P 500 index has several implications for investors. First, it means that the index’s performance is more heavily influenced by the technology sector than it has been in the past. This can be both a blessing and a curse, as the tech sector has historically been one of the most volatile sectors in the market. While this has led to strong returns for the index in recent years, it also exposes investors to greater potential losses if the tech sector experiences a downturn.

Second, the over-weighting of big tech stocks in the index can lead to a lack of diversification for investors who rely solely on the S&P 500 as a proxy for the broader market. With such a large portion of the index’s performance tied to a single sector, investors may not be as well-diversified as they believe, which can increase their portfolio’s overall risk.

The Risks of Over-weighting Big Tech Stocks

While the strong performance of big tech stocks has been a boon for the S&P 500 index in recent years, it also poses several risks for investors. One of the most significant risks is the potential for a tech sector downturn. As we’ve seen in the past, the tech sector can be prone to periods of rapid growth followed by sharp declines, such as the dot-com bubble of the late 1990s and early 2000s.

If the tech sector were to experience a similar downturn today, the impact on the S&P 500 index would be much more significant than it was during the dot-com bubble, due to the increased weighting of big tech stocks in the index. This could lead to substantial losses for investors who are heavily invested in the index.

Regulatory Scrutiny

Another risk associated with the overweighting of big tech stocks in the S&P 500 index is the potential for increased regulatory scrutiny. As these companies have grown in size and influence, they have also attracted the attention of regulators and lawmakers, who have expressed concerns about issues such as antitrust, data privacy, and content moderation. Increased regulation could have a negative impact on the profitability and growth prospects of these companies, which could, in turn, weigh on the performance of the index.

Can Investors Mitigate the Risks of this Overweighting

Well, no, not really. You might think that you could use a broader index to invest, such as the Russell 3000 or Wilshire 5000. The problem is that while those indices include more names, they are still market-weighted, and are thus still dominated by the huge tech names. The performance of those indices is also dominated by big tech performance. When you just start adding more tiny-cap tickers, you just add rounding errors onto the rump of the index.

Equal-weight indices are available, but those indices are essentially a big bet against the market. The reason that those names loom large in the index is that the market, using all available public information, has determined that Amazon should have a market capitalization that is much, much larger than most industrial firms. If you invest in an equal weight portfolio, you are betting against the judgement of the entire market, and you are betting massively in favor of relatively tiny names in the index. This strategy might carry much more risk than over-investing in tech.

My least favorite alternative is active investing. I’ve written a great deal previously against active investing, so I won’t re-iterate those drawbacks here. I am thoroughly convinced of the superior value of passive, index-based investing, and I think that means that you accept the weights as they are. In fact, although I have referred to this phenomenon as “over-weighting” throughout this article, I actually think that’s a misnomer. The index weighting is an accurate reflection of the relative value the market has placed on each of these firms.

Conclusion

The S&P 500 index’s over-weighting of big tech stocks is a reflection of the growing dominance of technology companies in the market, as well as a result of the index’s market-weighted structure. While this has led to strong returns for the index in recent years, it also exposes investors to potential risks, such as a tech sector downturn or increased regulatory scrutiny. However, if you are as committed to passive investing as I am, I think you have to just accept the market’s judgement that tech firms are extremely valuable.

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.