Last month I took a look at a question with some relevance to me personally: should I buy a new car? In a similar vein, this week I’d like to take a look at a question that a lot of my peers are currently facing, and one that I faced myself a few years ago. That is, I’d like to take a look at whether going back to school to get an MBA is worth it or not.

This is an example of a cost-benefit analysis. Cost-benefit analyses can aid our decision-making in a lot of situations. They can be used to figure out:

- which R&D project a company should devote resources to

- what price to buy a factory for

- whether you should make an investment in your own education

The basic idea behind a cost-benefit analysis to see if an MBA is worth it is 1) measure the total costs of getting an MBA, 2) define a baseline against which we will measure the “MBA bump”, 3) measure how much we can beat this baseline by, by getting an MBA, and 4) somehow account for the timing of these costs and benefits.

How much does an MBA cost?

This part is actually kind of complicated! You can’t just tally up tuition for two years. The full list of “costs” includes:

- Tuition for two years

- Foregone salary at your old job for two years

- Foregone pay raises at your old job

- Additional housing / travel expenses

- Financing costs for any new educational debt

Tuition: $100,000

Let’s look at all these in turn. According to U.S. News, the average full-time top-15 MBA tuition rose to barely over $50,000 per year in 2019. So let’s call it $100,000 for tuition. There’s probably a few thousand more in books and fees but I think we can ignore that for simplicity’s sake.

Foregone salary (including expected raises): $124,355

This part is also fairly simple, the only trick is we have to make some assumption about how much of a raise you would have gotten for your old job for the second year of the MBA program. Obviously this part varies quite a bit based on your own actual current salary.

For the first year, I used a rough average “old job” salary from the WSJ survey, $60,000. Figuring out what the second year of foregone salary is a little trickier. There are a few ways you could estimate this.

I chose to use the Bureau of Labor Statistics data for average weekly earnings for Q1 2019, broken down by age groups 25-34 and 35-44. Using this data, I see a 26.75% difference in earnings for a ten year gap. This annualizes down to about a 2.4% compounded salary growth rate.

This isn’t a very high-confidence input estimate for my model, but it only makes a difference of a few thousand dollars in the 2nd year of the MBA program so I’m not very concerned. My gut is that this should be a little higher, maybe around 4% to 5% to match up with nominal GDP growth expectations. And if anything, employees in their peak earning years should be getting the lion’s share of the raises in the overall economy. But we’ll stick with 2.4% for now.

Interest on new student loans: $56,058

Alriiiight, student loans! Everyone’s favorite subject. We have to make some assumptions here. I’ll assume you borrow the full amount for tuition and fees, partially finance your current living expenses through debt, and pay it all back over ten years starting right at graduation.

What’s the benefit of an MBA? How much more money will you make?

There are a few different data points we can pull from here. I’ll start with the WSJ / Times Higher Ed alumni MBA poll. The data here show that depending on which sector you end up in after your MBA, and whether you are a sector switcher or returning to the same sector, you can expect between a $34,000 and an $82,000 pay bump relative to your pre-MBA salary. The low mark was for switching into non-profits, and the high mark was for switching into consulting.

The Financial Times puts the post-MBA boost at about $72k, but they are measuring from pre-MBA to 3-years post-MBA. So I’d say this boost is in agreement with the WSJ data.

U.S. News puts the MBA bump lower, at around $25,000. This is a meaningful difference compared to the Wall Street Journal and Financial Times data. I don’t have the exact datasets, but based on the descriptions in the linked articles, it appears that the WSJ and FT data sampled mostly from the most selective MBA programs, whereas US News cast a wider net that included over 130 programs. This makes sense, the MBA salary bump would be expected to be lower at less selective programs.

As a final datapoint, the Graduate Management Admission Council published a study showing a median 90% salary increase post-MBA. This sounds roughly in line with WSJ / FT data, depending on what you assume for your starting salary.

A top-15 MBA is clearly a good investment in almost any case, as long as you have a decent amount of years remaining in your career. A standard MBA is a market-beating investment in most cases, but you have to be a little more careful about your individual circumstances, particularly the job sector you’d like to head into after graduating.

How big is the bump?

So putting all those datapoints together, let’s say you can expect roughly a 90% or $50,000 pay bump at an MBA program somewhere around the top 15 of the rankings, and a bump of around $20,000 for a “medium” ranked MBA program. Note: I bumped the U.S. News $25,000 down a bit, as that data also included the most selective programs.

As a quick sanity check, this seems roughly correct to me. In my personal experience, I went to a solid, but not top 15 MBA program, and my bump was on the higher end of that range (95%-ish pay bump). I think that is mostly because I was going from one of the lower paying sectors (public, military) to one of the higher paying sectors (financial services). So I think we’re on the right track. Obviously, these figures have large situational variances.

As we mentioned before, let’s assume a pre-MBA salary of around $60,000. This is roughly where the WSJ had it, and it seems about right to me.

Post-MBA salary growth

I also have a hunch that expected salary growth for new-ish MBAs is a good deal higher than the national economy average for age-group peers, so let’s conservatively say 5% instead of the 2.4% we got from BLS. After 5 years, we’ll scale this back down to 2.4%.

How long does the benefit last?

This is a pretty important factor that gets overlooked quite a bit. How much longer do you have before retirement? This has a huge impact on the benefit side of the equation. For example, if you are 50 years old, you are only going to have 10 or 12 years of increased salary to try to make up for the $200,000+ investment in education.

Putting it all together

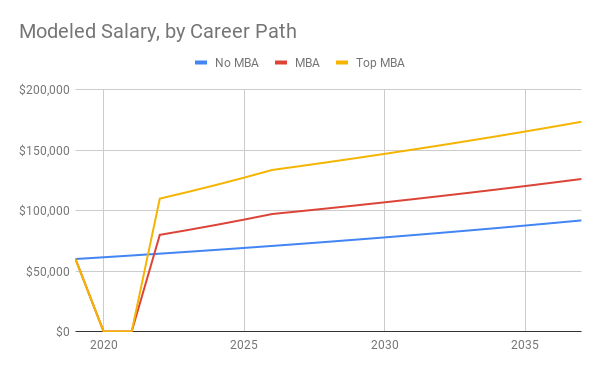

So let’s start trying to stack these cost up against the future benefits. To start, let’s visualize our earnings path.

Pretty striking, right? You can expect a 2020-21 MBA investment at a top 15 program to recoup the foregone salary by mid-2024. And a standard MBA can be expected to recoup the lost salary by mid 2027. But, we haven’t looked at the other factors yet. We still have to consider the actual tuition costs, debt financing costs, and any other life disruptions like additional housing / travel.

What else do we need to bake into the cake?

OK, we’re part-way there, but we need to add in all the rest of our costs, account for taxes, and also account for timing.

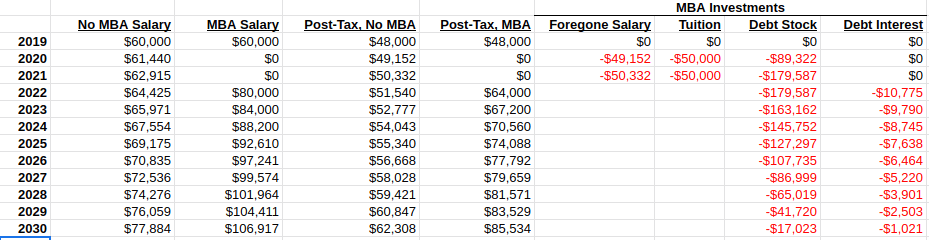

A full accounting of all MBA costs

Let’s consider the MBA decision as two phases. First, we have an investment phase, during which you are falling behind your pre-MBA financial trajectory. You’re falling behind by foregoing salary, spending tuition money, and possibly incurring other expenses.

I think the investment path for both types of MBA programs is similar here. In other words, to simplify, I’ll assume that tuition / financial aid / debt is similar for all full-time MBA programs. I’ll also assume that you attend an MBA program at a location that has similar housing costs to your current home, such that there are no incremental housing costs. If you have to increase housing expenses, and especially if you have a family at a separate location (doubling your housing needs), you will definitely need to factor this in.

Finally, I assume that all of the relevant salary levels here pay a total effective tax rate of 20%, federal, state, and local. I know this is wrong, but I don’t think it will make a huge difference and it’s a lot of unnecessary work to fully model out all these taxes. So I’ll assume that the debt incurred is 100% of the tuition amount, plus 80% of the foregone after-tax salary. In other words, I’m assuming that pre-MBA, 20% of your after-tax earnings was being saved, and that you are temporarily going to save/invest zero dollars for your two MBA years.

Cash flow timing and our return on investment

A key here is that money now is better than money later. Not always, but almost always. So when we weigh, we have to weigh earlier costs and benefits more heavily than later costs and benefits. We can do this by using the language of interest rates and the internal rate of return of an investment.

The quick-and-dirty summary of our full investment in education is:

- Two years of negative cash flow due to tuition and foregone salary

- Ten years of positive cash flow due to the post-MBA salary bump, slightly counteracted by interest expenses on our new student loans

- Twenty to twenty-five years of un-tarnished positive cash flow due to the salary bump after the debt is paid off

Without getting into the details, the internal rate of return (IRR) measurement will take this entire series of cashflows, and create an investment with an equivalent interest rate of return. In other words, an IRR of 5% tells you that a series of cash flows is equivalent to a standard financial investment of a single upfront investment and a series of equal-sized payouts of 5%, like a savings account.

Side Note: This is not the technical definition, but I think it’s close enough to understand the concept. The more accurate definition is that an IRR is the interest rate that makes the present value of the cash outflows equal to the present value of the cash inflows. Boooring.

I also included, as a reference, an example of a situation where an MBA investment doesn’t seem to be worth it. The third measurement below of a -4.5% IRR is for a standard MBA for a person with roughly 10 years remaining until retirement. Because you only have ten years of the salary bump, you actually never catch back up to your pre-MBA earnings trajectory.

Investment returns for different MBA career paths

| MBA Path Type | Internal Rate of Return (IRR) | Payback Period (years) |

| Top-15 MBA | 19.41% | 5-6 |

| Standard MBA | 8.6% | 12-13 |

| Standard MBA, short-timer | -4.5% | Nope |

So there we have it! A top-15 MBA is clearly a good investment in almost any case, as long as you have a decent amount of years remaining in your career. A standard MBA is a market-beating investment in most cases, but you have to be a little more careful about your individual circumstances, particularly the job sector you’d like to head into after graduating. Keep in mind that these returns are after-tax, so 8.6% is still very attractive compared to, say, the after-tax returns to be expected from U.S. stocks.

Other factors to consider

So let’s think about how individual situations can impact this analysis. You’ll notice I made a lot of simplifying assumptions throughout. If any of these can be wrong for you, you can expect your results to vary from mine.

Housing and travel costs

This is a big one. If, for example, you have a spouse and children, and you have to rent an apartment in a different city to go to a full-time MBA program, make sure to consider housing and travel costs. Most MBA programs are located in major urban centers, so rent alone could easily run you $24,000 per year. Your family back home might incur additional childcare costs, and you will likely spend more than normal on travel to go back home on weekends / vacations.

Your own expected salary bump

All of my analysis was based on broad averages. If you are currently working on Wall Street, and post-MBA you plan to work at the State Department, you are going to get less than the average bump. You have to consider this– it takes much longer to pay your investment in tuition and foregone salary back if the end result is going to be just an extra $10k per year. Note that this can apply to other graduate degrees as well. Before you dive into grad school, do some research on what the “Masters” or “PhD” bump is in your profession. It takes a pretty big bump to justify a $150,000+ investment.

Scholarships

You’ll notice I assumed that you are paying full-freight for tuition. But a lot of MBA programs offer a lot of financial aid. So that can drastically reduce that $100k number we used for the tuition investment. I myself had a great deal of my MBA financed through the Army Post 9/11 G.I. Bill. Free or reduced tuition costs can make this decision a lot easier!!

Prep work

We’ve assumed all along that your personal investment in an MBA begins right when you leave your old job. But in many cases, you are going to have to devote a lot of your time and effort leading up to business school to prep work. You’re most likely going to have to take the GMAT. That can eat up a lot of time for studying and practice testing. You might also need to spend time gathering references, completing pre-req coursework, filling out essays, traveling for application interviews, etc. Your time is valuable and these are all additional investments your are making.

Generalizing this advice

So we’ve looked at the costs, looked at the magnitude of the MBA “bump”, and then we did some financial stuff to account for timing and bake everything into a rate of return on our MBA investment. How can we use this framework for other decisions?

You don’t actually need to research how to calculate an IRR. The most important components of what we just did have nothing to do with the financial calculation. The key is that you take the time to fully identify money going out versus money coming in. For example, it’s common for people to evaluate grad school decisions by only looking at the bump compared to the tuition investment, ignoring the large amount of money they’re giving up by not working for two years. If you fully identify all the cost / benefit components, you likely already have enough information to make a pretty good decision.

Non-financial considerations

We’ve only discussed the financial impact of an MBA education. That makes sense, this is a financial advice blog and I am a financial geek. But there are other things to consider!

Work-life balance

First, quality of life. We’ve based a lot of our financial analysis on the average MBA salary bump that MBA graduates can expect to receive. But the top-end of that average includes a lot of industries that have a reputation for poor work-life balance. Investment Banking, Management Consulting, Tech, and Marketing all fall in this category.

This is an important point to consider. If you are making $50,000 a year working 40 hours per week before your MBA, and post-MBA you are making $100,000 a year working 80 hours, how much did you really benefit? I felt like I was in that kind of situation in my first job out of business school and that’s why I don’t work at an investment bank anymore.

The intrinsic value of education

I love learning. I take online courses for random stuff totally unrelated to my professional life all the time. Part of the reason I started the Luther Wealth project three years ago is that I learned how to code as a hobby and then realized I could improve upon the market standard for portfolio optimization software.

But! Compared to the average grad school program, I don’t think the educational content of an MBA program is on-par with most other higher learning endeavors. I don’t have any other grad experience, so I can’t say for sure, but my gut is that most MBA programs don’t really have as much educational content as something like a Law Degree or a Masters in Education. The MBA curriculum, for me, was more about learning a problem-solving framework, presentation skills, and some basic business education. So I’d say the “education is fun” angle should not be a big factor for you deciding to go for an MBA.

It’s fun and you meet a lot of cool people 🙂

Many people extol the networking benefits of an MBA program. This is true, but I never liked the term “networking”, which seems to conjure up images of cocktail tables in a conference center where everyone is spewing their elevator pitch to whomever will listen. The truth is, you will meet a bunch of cool people you will become friends with in business school. You’ll stay friends, and you’ll probably do business with a few of them later in life. That’s “networking”, I guess, but I always thought that was a lame label for something great.

But keep that in mind! Apart from the financial benefits, you will make a bunch of friends at B-School and that is great!

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.