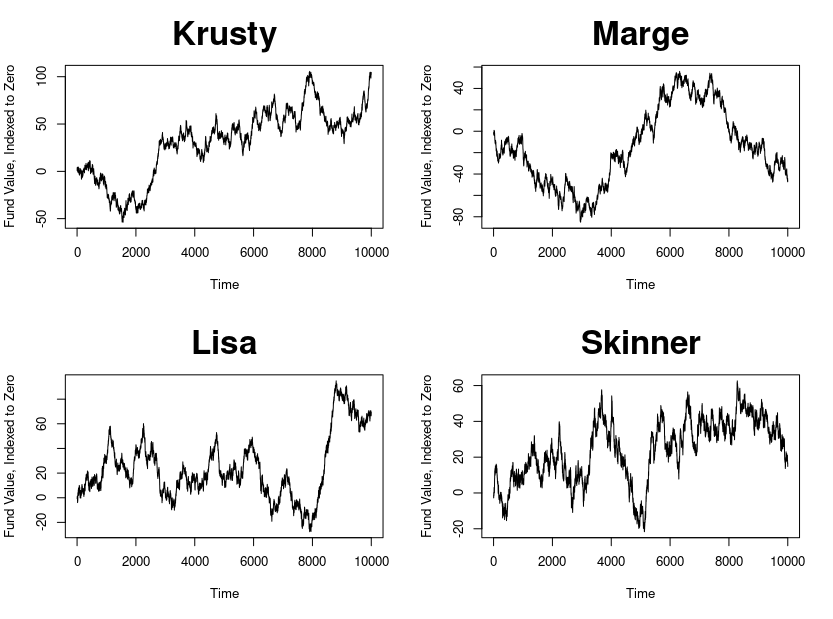

2022 has been an extremely bad year for almost every asset class! Stocks and bonds have suffered large losses. And inflation has been high, further eroding the value of investors’ savings. In a bear market, it is absolutely critical for long term investors to avoid panic selling at all costs.

I generated this text in part with OpenAI’s large-scale language-generation models. Upon generating draft language, I reviewed, edited, and revised the language to my own liking and I take ultimate responsibility for the content of this publication.