Nothing fancy here, just a quick list of my favorite financial sites (besides Luther Wealth) and what I use them for. It’s a fairly short list, because most financial sites are actively harmful to the typical investor.

Investing the right way

Nothing fancy here, just a quick list of my favorite financial sites (besides Luther Wealth) and what I use them for. It’s a fairly short list, because most financial sites are actively harmful to the typical investor.

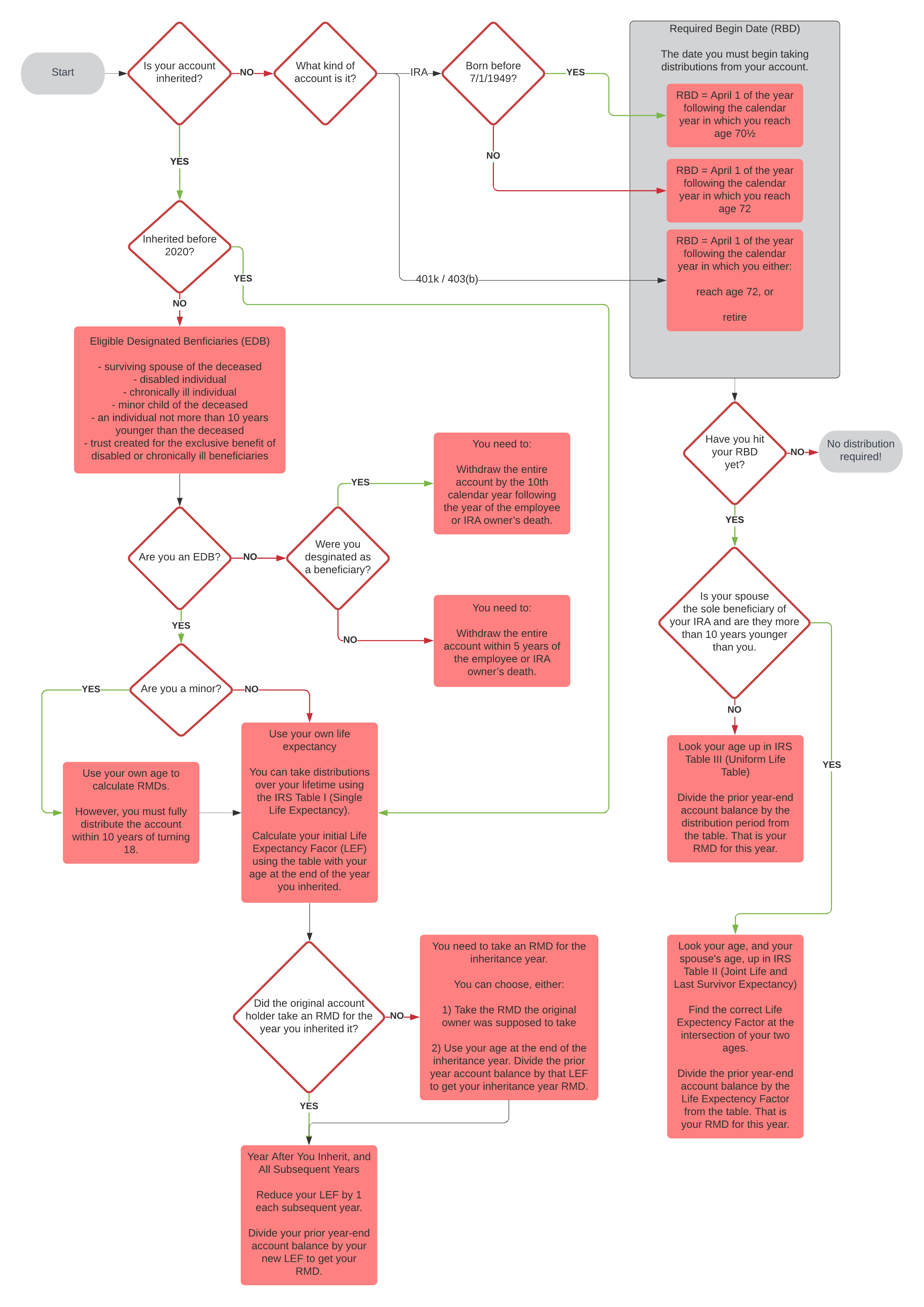

Do you have money invested in a retirement account? If so, you may be responsible for taking Required Minimum Distributions (RMDs) every year to avoid IRS penalties. Unfortunately, the IRS guidance on the topic is quite confusing. I have attempted to assemble my own RMD notes into a helpful flowchart for determining if you are subject to RMDs. Please keep in mind that I am not a tax adviser or accountant. This is not tax advice. You are ultimately responsible for correctly calculating your RMD.

Most retirement accounts confer some type of tax advantage. The federal government designed them to help individuals save for retirement. The government didn’t design them to establish multi-generational tax shelters. So, in most cases, when a retirement account holder reaches a certain age, or passes away, the IRS requires the account to start gradually liquidating.

Bitcoin is a monetary system. The best way to understand it is in comparison to two other monetary technologies: the gold standard and the U.S. Federal Reserve. In both of these systems, you need a way to control how much money exists (supply), and how people give it to each other (exchange). Bitcoin is simply one more way to implement supply and exchange of currency.

Bitcoin is also a thing that random d-bags talk about to each other, and to their bored dates. We will not discuss that aspect of bitcoin here but it’s actually the predominant societal aspect of bitcoin.

This article was originally posted on December 14, 2015 and updated on December 1, 2021.

For several years, I’ve been thinking about buying a car. This is a big deal for me, because I have owned exactly one vehicle in my life, a 2004 Ford Ranger. He’s my buddy. I feel bad about looking for a new one, but it’s time (or so I thought). One consequence of my vehicle loyalty is that I haven’t given any thought to buying a car since long before I was interested in financial planning.

It’s pretty confusing! So I want to share my thought process here to illustrate 1) a way to think about buying cars, and 2) how the economics of car ownership can be an example of how we can use a financial modeling approach to simplify other complicated decisions.

Continue reading “Should I Buy A New Car?”How much is your financial adviser charging you? You might not know, and if you think you know, you might be wrong. The industry is rife with deceptive pricing practices and it’s easy to miss details, even if you read the fine print. In some cases, advisers can even structure fees to be completely invisible to the client.

Investor protection is probably the #1 thing I spend time thinking about at Luther Wealth. As an independent financial adviser, it can be tough for a prospective client to trust that I will safeguard their savings. Although I’m constantly looking to improve, I am very proud of the level of security I can offer my clients.

I can’t think of a worse investment than penny stocks. Maybe a Ponzi Scheme is worse? Debatable.

Penny stocks seem to be gaining popularity as a water cooler investment. They are esoteric. They seem to require a lot of research. Similar to cannabis stocks, crypto, and Gamestop, they are fun to talk about.

I have been using a self-developed web app called Indie Adviser for the past year to help with my work as an independent financial adviser. Next week, I’m planning to open it up publicly in a limited demo / beta test. Here’s the demo video– check it out and let me know what you think!

I have been hearing a lot lately about Acorns. It’s a savings app which automatically rounds your card purchases up to the nearest dollar and invests that spare change into a diversified set of ETFs. It’s a fun concept and an interesting way to get early-stage investors accustomed to saving for retirement. And it’s nice that it’s a lightweight app so the barrier to entry is very low.

The problem is that Acorns cannot possibly help you save any useful amount. The system of rounding up is totally inadequate for retirement savings. And even more importantly, Acorns is extremely expensive.

Continue reading “Acorns is Overpriced and Underpowered”I just finished a run in my neighborhood. Took about 70 minutes. To pass the time, I decided to keep track of how many drivers I ran by that were texting and driving. Based on my very professional, scientific results, I have concluded that basically everyone is spending a large portion of their drives texting.

Continue reading “Everyone is Lying About Texting and Driving”