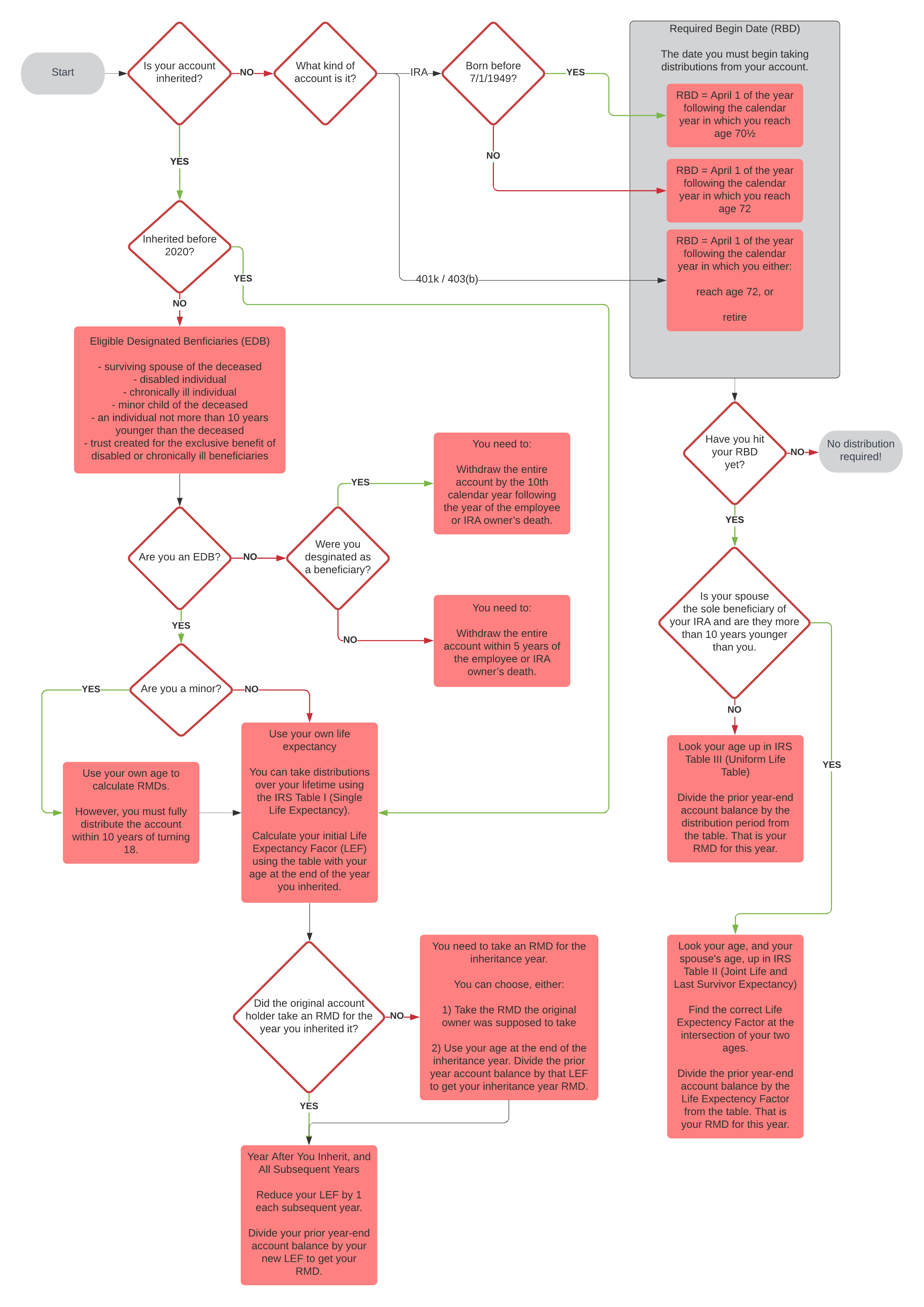

Do you have money invested in a retirement account? If so, you may be responsible for taking Required Minimum Distributions (RMDs) every year to avoid IRS penalties. Unfortunately, the IRS guidance on the topic is quite confusing. I have attempted to assemble my own RMD notes into a helpful flowchart for determining if you are subject to RMDs. Please keep in mind that I am not a tax adviser or accountant. This is not tax advice. You are ultimately responsible for correctly calculating your RMD.

Why does the IRS require distributions?

Most retirement accounts confer some type of tax advantage. The federal government designed them to help individuals save for retirement. The government didn’t design them to establish multi-generational tax shelters. So, in most cases, when a retirement account holder reaches a certain age, or passes away, the IRS requires the account to start gradually liquidating.

Here’s an example: The Ten Year Rule

Let’s say I inherited a Roth IRA this year (2021) from my grandfather who designated me as a beneficiary to the account. According to the flowchart, I do not qualify as an Eligible Designated Beneficiary, so I am subject to the 10 year rule and must fully liquidate the account within 10 years of inheriting it.

Another example: Inherited from Spouse

I inherited a 401(k) plan this year (2021) from my spouse, so I’m an EDB. Assuming my spouse was not required to make a Required Minimum Distribution in 2021, I would be able to use my own age in Table I to calculate my RMD. I would divide the 2020 year-end account balance by my Life Expectancy Factor for 2021 based on my age at the end of 2021. That calculation gives my 2021 RMD which I would have to withdraw before the end of the year.

Invest with Luther Wealth

I’m interested in talking to you about your retirement savings and investments! If you’d like to discuss investing with Luther Wealth, please contact me!

Don’t miss out on future posts!

Don’t miss any new posts! Sign up below to subscribe. I generally post once per month and I alternate between longer-form articles and short digests of interesting financial content from other sites I’ve found. Thanks for reading!

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.