This is Part 1 of a series of posts about various cognitive errors that lead to poor investment decisions. Part 1 deals with confirmation bias.

I know that most men—not only those considered clever, but even those who are very clever, and capable of understanding most difficult scientific, mathematical, or philosophic problems—can very seldom discern even the simplest and most obvious truth if it be such as to oblige them to admit the falsity of conclusions they have formed, perhaps with much difficulty—conclusions of which they are proud, which they have taught to others, and on which they have built their lives.

Tolstoy, What is Art, 1897

The average investor isn’t very good at it

The modern middle class investor beginning their retirement savings has full access to the same investments as the wealthiest and most sophisticated investors. Index funds and ETFs provide a cheap way to invest in the vast majority of global liquid assets. This has made the playing field for investing mostly flat, for the first time in history!

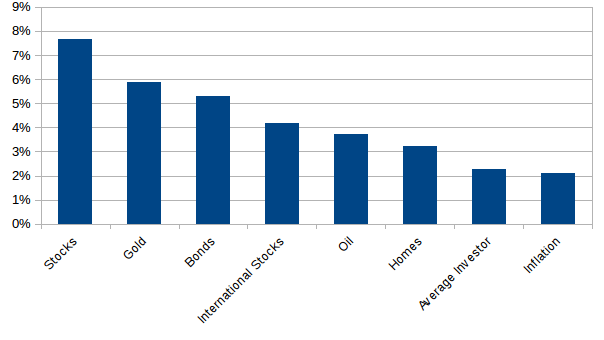

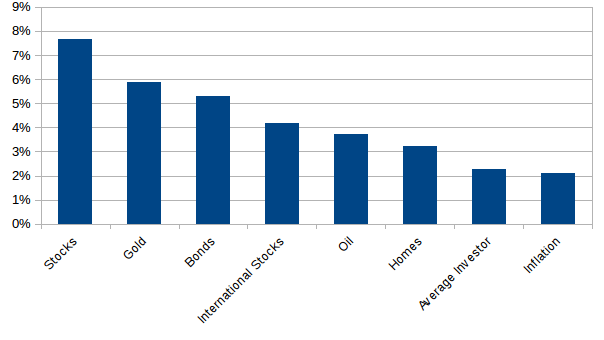

Despite this historically flat playing field, most investors don’t come anywhere close to a “market return”. Blackrock has compiled some data from 1997-2016 showing annual individual asset returns compared to the average investor:

Continue reading “Cognitive Bias Series: Confirmation Bias”