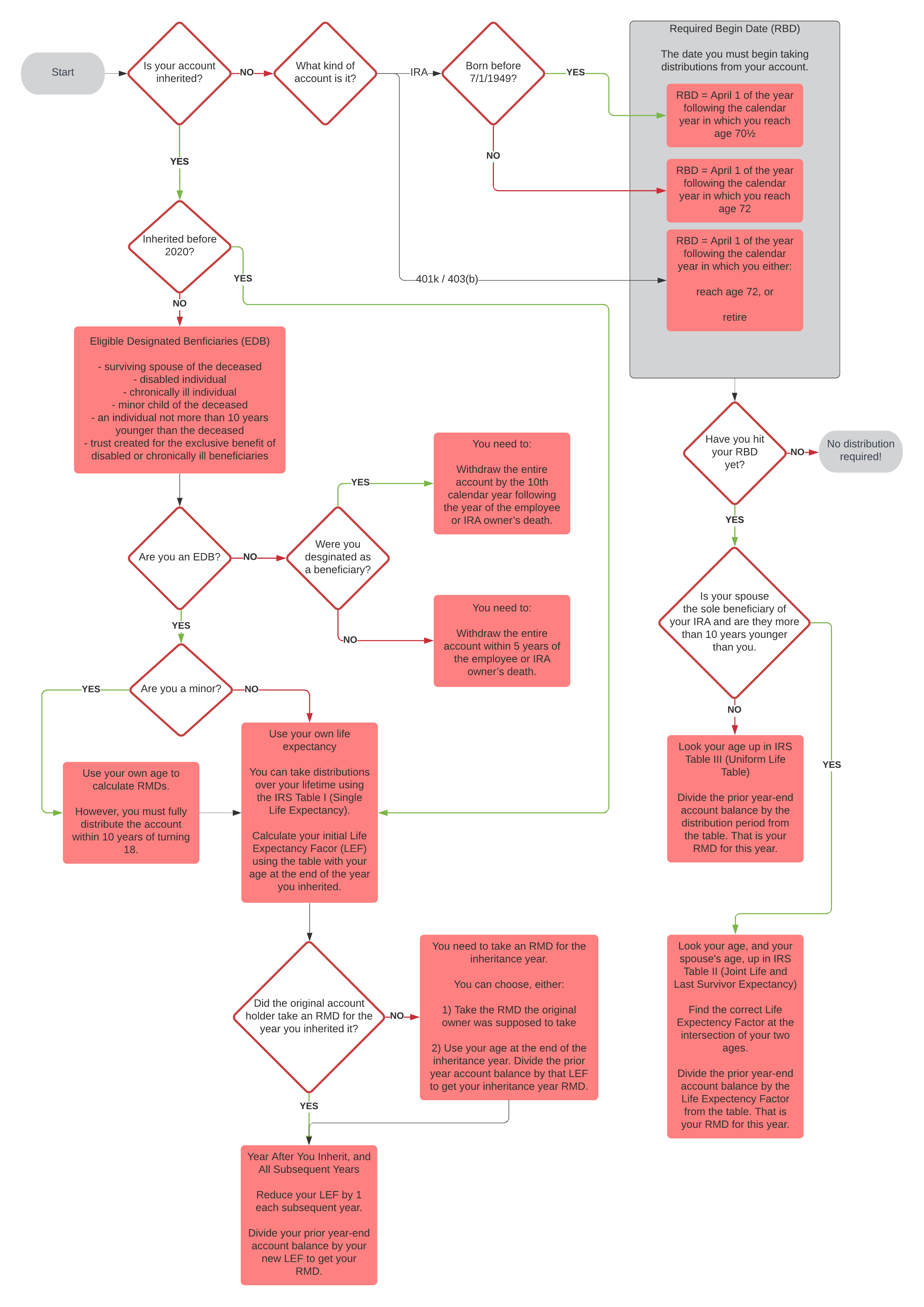

Do you have money invested in a retirement account? If so, you may be responsible for taking Required Minimum Distributions (RMDs) every year to avoid IRS penalties. Unfortunately, the IRS guidance on the topic is quite confusing. I have attempted to assemble my own RMD notes into a helpful flowchart for determining if you are subject to RMDs. Please keep in mind that I am not a tax adviser or accountant. This is not tax advice. You are ultimately responsible for correctly calculating your RMD.

Why does the IRS require distributions?

Most retirement accounts confer some type of tax advantage. The federal government designed them to help individuals save for retirement. The government didn’t design them to establish multi-generational tax shelters. So, in most cases, when a retirement account holder reaches a certain age, or passes away, the IRS requires the account to start gradually liquidating.