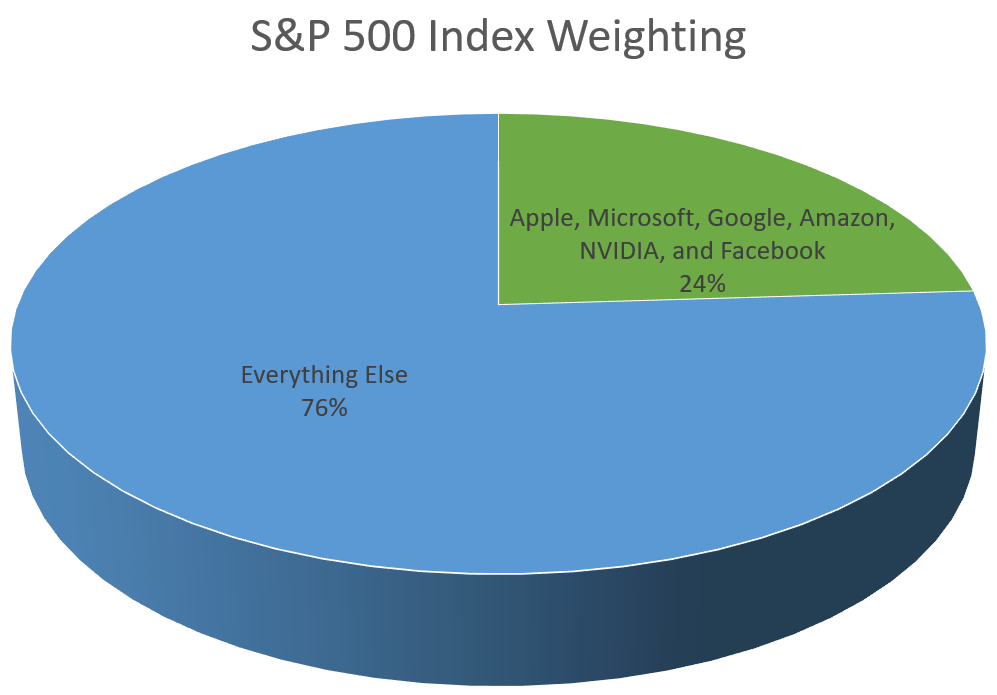

The S&P 500 index, a widely followed benchmark of the U.S. stock market, has long been considered a reliable indicator of the overall health of the economy. However, a closer look at the index reveals a surprising concentration in big tech stocks. This phenomenon is not only a reflection of the growing dominance of technology companies in the market, but also a result of the market-weighted structure of the index. Let’s explore the reasons behind this concentration and discuss the potential risks it poses to investors.